Mortgage Loans to Help You Buy or Refinance Your Dream Home

We find the right mortgage loan for you so you don’t feel frustrated and overwhelmed.

You Get the Right Mortgage Loan Every Time

Lenders only offer you their mortgage loans, but we search among many more lenders to find the lowest cost mortgage that saves you money, time, and frustration.

Save Time

Save Money

Get Your Dream Home

Lenders Who Trust WeDoLoans

Choosing the Wrong Mortgage Loan Can Cost You Thousands

We’ve helped our customers save over $11 million dollars in interest.

How?

They followed our advice and avoided the wrong mortgage loan.

3 Easy Steps to Find the Right Mortgage

1) Get Started Now

2) Get A Custom Plan

3) Get Peace of Mind

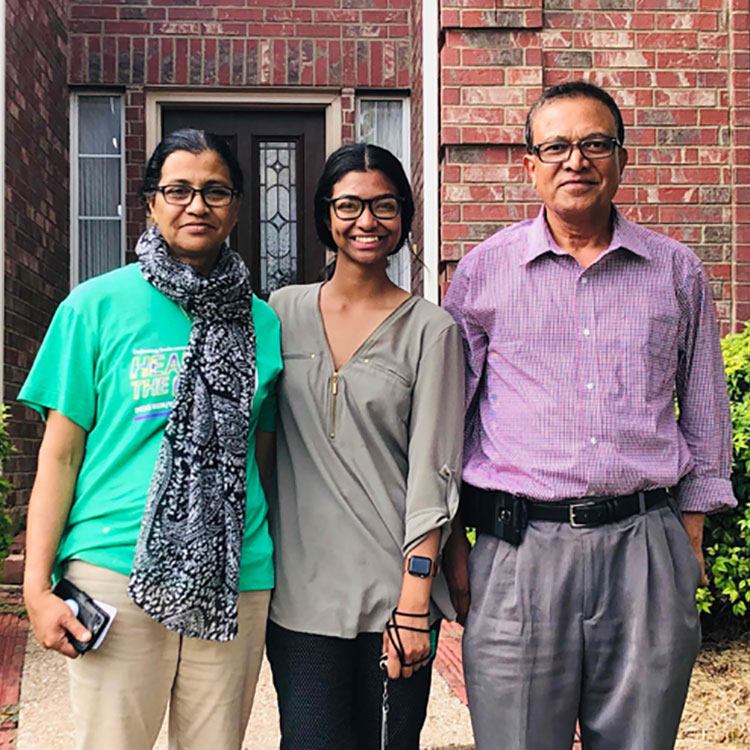

Testimonials

Hear From Others

We have worked with WeDoLoans on two home purchases and a refinance most recently. I have and will continue to recommend my friends and family to WeDoLoans!

– Alyson Collins

Once we found our perfect home, they let us know exactly what documents were needed and got right to work. Easiest process ever.

– Farzana Musharof

Get Peace of Mind with the Right Mortgage Loan

30 Year Fixed

The traditional 30-year fixed-rate mortgage has a constant interest rate and monthly payments that never change. This may be a good choice if you plan to stay in your home for seven years or longer. If you plan to move within seven years, there may be better loan options available for you.

15 Year Fixed

This loan is fully amortized over a 15-year period and features constant monthly payments. It offers all the advantages of the 30-year loan, plus a lower interest rate and you’ll own your home twice as fast. The disadvantage is that, with a 15-year loan, you commit to a higher monthly payment. Many borrowers opt for a 30-year fixed-rate loan and voluntarily make larger payments that will pay off their loan in 15 years. This approach is often safer than committing to a higher monthly payment, since the difference in interest rates isn’t that great.

Adjustable Rate Mortgage

An ARM is an Adjustable Rate Mortgage. Unlike fixed rate mortgages that have an interest rate that remains the same for the life of the loan, the interest rate on an ARM will change periodically. The initial interest rate of an ARM is lower than that of a fixed rate mortgage, consequently, an ARM may be a good option to consider if you plan to own your home for only a few years; you expect an increase in future earnings; or, the prevailing interest rate for a fixed mortgage is to high.

FHA Loans

An FHA loan is a mortgage loan that is insured by the Federal Housing Administration (FHA). Essentially, the federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments.

VA Loans

A VA loan is a mortgage loan in the United States guaranteed by the U.S. Department of Veterans Affairs (VA). The loan may be issued by qualified lenders. The VA loan was designed to offer long-term financing to eligible American veterans or their surviving spouses (provided they do not remarry).

Jumbo Loans

A jumbo loan is a loan that exceeds the conforming loan limits as set by Fannie Mae and Freddie Mac. As of 2020, the limit is $510,400 for most of the US, apart from Alaska, Hawaii, Guam, and the U.S. Virgin Islands, where the limit is $726,525. Rates tend to be a bit higher on jumbo loans because lenders generally have a higher risk.

USDA Loans

The United States Department of Agriculture (USDA) gives out a variety of loans to help low- or moderate-income people buy, repair or renovate a home in a rural area. Some of the popular types of loans are: the single family direct homeownership loan, the single family guaranteed homeownership loan, the rural repair and rehabilitation loan or grant and the mutual self-help loan.

Hero Loan

The purpose of this loan program is to promote home ownership amongst heroes in our community. Eligible Heroes include: Veterans, Active Duty Military, Law Enforcement, Educators, First Responders, Nurses or Healthcare Workers. The program is self-managed by the Real Estate Agent and it involves internet promotions to foster activity and encourage heroes to apply for the discount.

Heroes will receive the following: 1) Real Estate Agent rebate of $1,000 applied to closing costs or as a check at close; 2) Mortgage Broker $500 appraisal rebate at close; 3) Mortgage Broker waives underwriting fee $1,000 value; 4) Discount on Home Inspection; and 5) Discount on Home Insurance through our insurance network. To participate, heroes need to be registered by the agent or lender to be confirmed for eligibility.

With 18+ Years of Experience, We Help You:

Buy or refinance your home and stay within your budget

Navigate the entire loan process so you won’t feel overwhelmed

Find the right mortgage loan so you save money

How We’ve Helped

$11 Million+

Saved by our clients in loan interest by avoiding the wrong loans.

5★ Google Reviews

Our clients highly recommend us!

1000+

Clients have found the right mortgage without feeling overwhelmed.

24/7

We always provide personalized services. No bots. Real people.

Discover 3 Mistakes to Avoid on Your Home Mortgage

These Tips Will Save You Money!

Before You Buy, Do You Need To Know What’s Your Home Worth?

The Only Mortgage Calculator You’ll Ever Need

Our Blog

We’ve Been Making Mortgage Loans for 18+ Years

Knowledge is power. Our blog helps you learn how to avoid the common mistakes that cost homeowners frustration, lost time, and thousands of dollars.

Is It Getting More Affordable To Buy a Home?

Over the past year or so, a lot of people have been talking about how tough it is to buy a home. And while there’s no arguing affordability is still tight, there are signs it’s starting to get a bit better and may improve even more throughout the year. Elijah de la...

Is It Better To Rent Than Buy a Home Right Now?

You may have seen reports in the news recently saying it’s more affordable to rent right now than it is to buy a home. And while that may be true in some markets if you just look at typical monthly payments, there’s one thing that the numbers aren’t factoring in: and...

Should I Wait for Mortgage Rates To Come Down Before I Move?

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.In the housing market, there’s a longstanding...

What Makes WeDoLoans.com Different?

At WeDoLoans we know that you want to get the right mortgage loan to buy or refinance your dream home so you can save time, money, and have peace of mind. In order to do that, you have to spend excessive amounts of time and effort searching for a lender who can find the right mortgage loan that fits your financial needs. The problem is you feel overwhelmed with information overload about different types of lenders, loans, terms, and a thousand other details that you do not want to misunderstand so you do not regret the mortgage loan that you choose. We believe there is a smarter way to buy or refinance your dream home.

We understand choosing a mortgage lender among thousands of lenders can overwhelm you which is why we shop the market for you to find the best mortgage loan to fit your financial needs. With more than 18 years experience, we have helped our clients save more than $11 million in interest by avoiding the wrong mortgage loan. How? Glad you asked.

The smarter way to buy or refinance your dream home only takes 3 easy steps:

1) Get Started Now. Complete a simple online form to tell us about your home buying or refinancing goals.

2) Get A Custom Plan. We’ll guide you through the process to find the best mortgage loan that fits your financial needs, and you won’t feel overwhelmed.

3) Get Peace of Mind. You’ll save time, money, and be confident that you chose the right mortgage loan.

So, get started now to learn how you can save thousands on interest by avoiding the wrong mortgage loan!

And in the meantime, download our most popular article, “Discover 3 Mistakes You Should Avoid When Buying or Refinancing Your Home.”

There is no reason to choose the wrong mortgage loan, waste thousands of dollars, and regret that decision for years to come. Instead, you can save time, money, and get peace of mind when financing your dream home.